- Admin

- 3716 views

- 2 minutes

- Feb 20 2024

Seamless data analytics solutions to an InsurTech business DiscoverMarket – SG

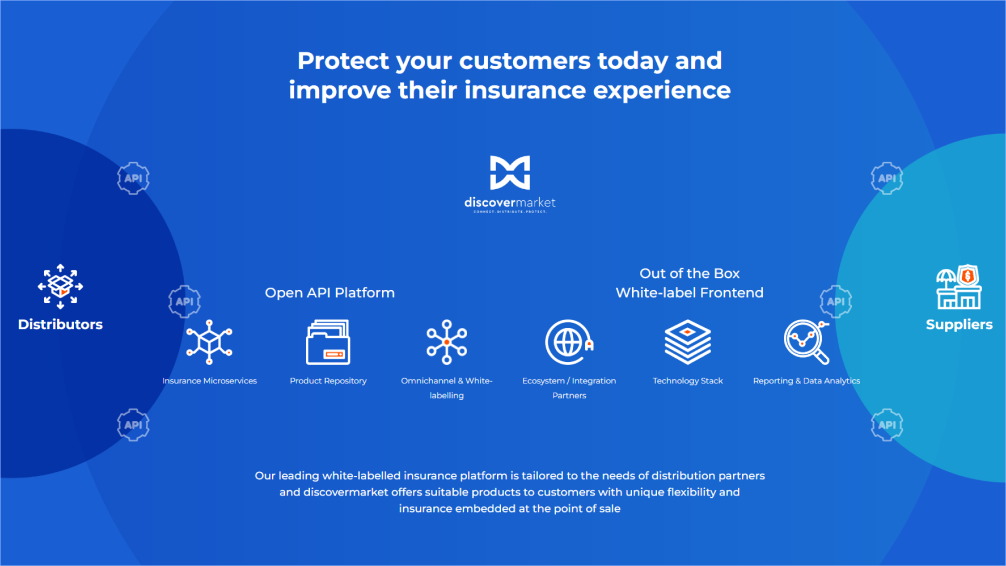

DiscoverMarket, a leading innovator in Embedded Insurance, provides a range of insurance-related services, including a marketplace where individuals and businesses can compare and buy insurance. Their platform offers a complex ecosystem, connecting various participants in the insurance value chain, with the goal of streamlining business operations and offering a smooth insurance buying experience.

Highlight results

– 100% website automation testing

– 10K+ traffic access at the same time

– 2X increase in delivery speed

Key challenges

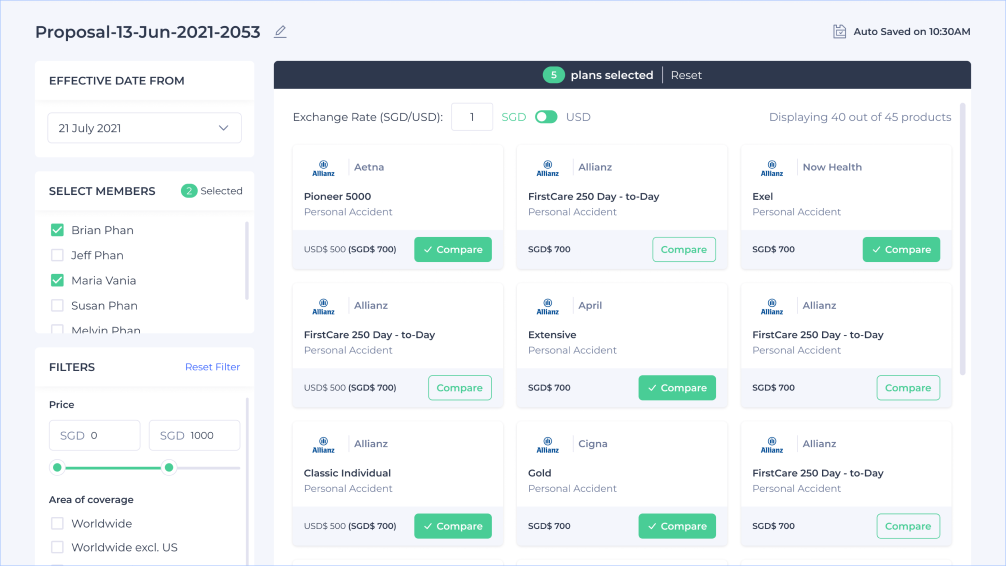

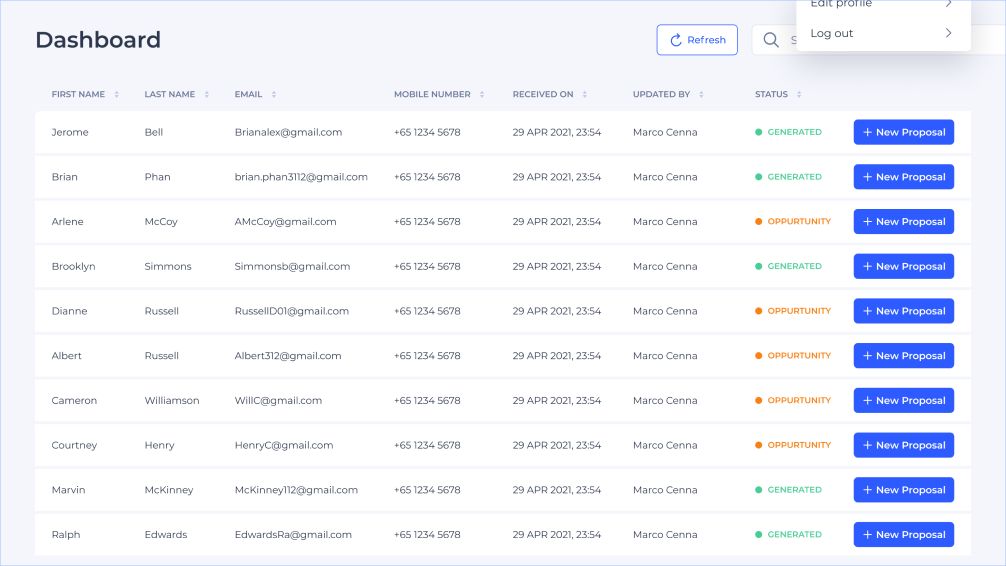

– Needed to develop a robust, secure, and scalable platform for the Insurance domain, where end users can search insurance products and compare quotes, as well as admin users can set up and manage products, customers, proposals, and so on.

– Needed to create an M.A.C.H Microservices and Micro Frontends architecture that aligned with 12-factor, where we had to guarantee data security and performance.

– Needed to set up different sub-teams to handle each business separately for different features and domains, The team members are all working remotely from different locations and time zones, which causes communication issues, delays, and coordination issues when performing tasks.

– Juggling ongoing maintenance tasks with the simultaneous development of new features, balancing priorities to keep the existing system stable while innovating.

– Automated systems for handling risk assessment and fraud detection, reducing the manual workload and increasing accuracy.

– Difficulties in utilizing cloud services across several different countries, navigating the complexities of international regulations, and varying service availability.

Our solutions

– ITC provided a safe approach and cost savings for the client by segmenting the project into multiple phases, from proof of concept (PoC) to minimum viable product (MVP).

– Utilized a multi-cloud strategy (Azure and AWS) to solve the problem of syncing data using

sharding and replication technologies

– Designed and implemented secure microservices using AI ChatBot, GitHub Copilot, and the best

practices for passwordless authentication (Passkey technology)

– Improved the deployment process by adopting a Trunk-Based Development approach,

implemented automated testing, and conducted security testing of APIs through contract testing

– Enforced robust security protocols to safeguard sensitive customer data

– Provided user-friendly insurtech software with different types of insurance comparative and real-

time reports

– Provided skilled full-stack engineering teams to develop the platform

– Implemented Agile practices across all teams to enhance delivery efficiency.

Project details

Project type: Dedicated team

Services: Website development (Front-end, Back-end, DevOps), Testing & QA service, Consulting service

Industries: Insurance

Technologies: Microservices; Micro FrontEnds; Java; Spring Boot; Spring Cloud; Spring Retry; Spring JPA; Spring Aspects; Spring Security; Angular; State Management; RxJS; TypeScript; ES6+; HTML5 & Bootstrap; CSS; SCSS; TailwindCSS; Redis; MongoDB; CosmosDB; ELK; Active Directory; Virtual Network; AKS; Blob Storage; CDN; App Gateway; API Management; Developer Portal; WAF; Service Bus; App Services; Cosmos DB; Clarity; SAST; DAST; Automation Testing; CI/CD; JMeter; Jenkins; GitHub Actions; Gitlab Registry; NewRelic; Git-flow.