- Admin

- 4619 views

- 2 minutes

- Feb 20 2024

Big Data and Loyalty Solution best fits with IZIon24 – VN

A Snapshot

IZIon24, an ambitious insurtech startup, is transforming how the younger generation engages with insurance. With a bold vision to democratize access to insurance products and reimagine how insurance is perceived, IZIon24 sought to build a future-proof digital platform that could scale across Vietnam’s vast insurance market. ITC partnered with IZIon24 to deliver a highly scalable, AI-driven platform that supports seamless integrations, next-gen UX, and full-stack development to power their mission.

The Business Challenge

IZIon24 confronted a series of strategic and technical challenges on their path to disruption:

Market-Ready Infrastructure

- Required a robust, adaptable insurance core system capable of serving millions of users across life and non-life segments.

Complex Integration Needs

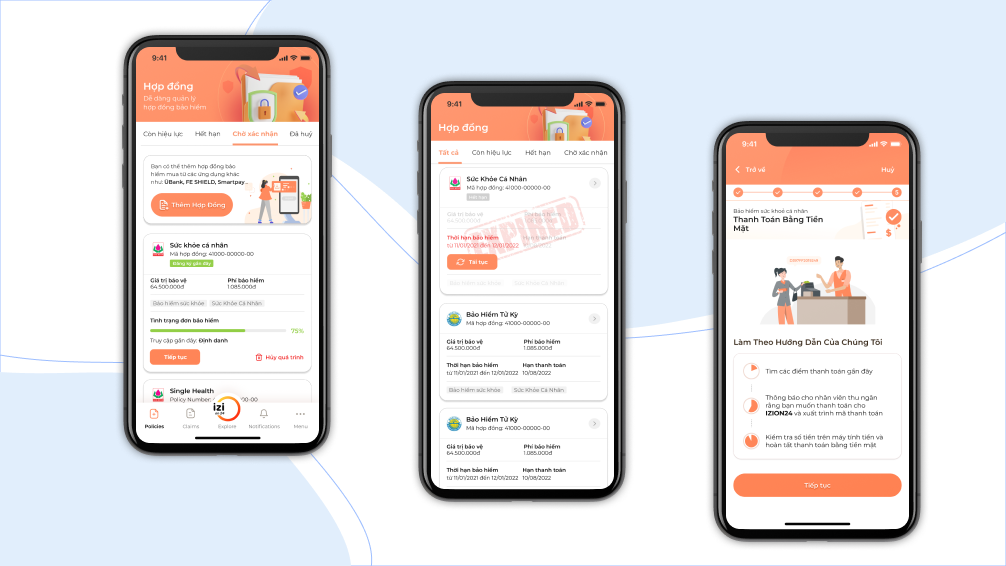

- Needed seamless integration with diverse payment gateways (Momo, SmartPay, Bankcard, Payoo) and insurance partners.

- Also required third-party tools like OCR, CleverTap, and analytics layers to personalize and optimize user experiences.

User-Centric Design

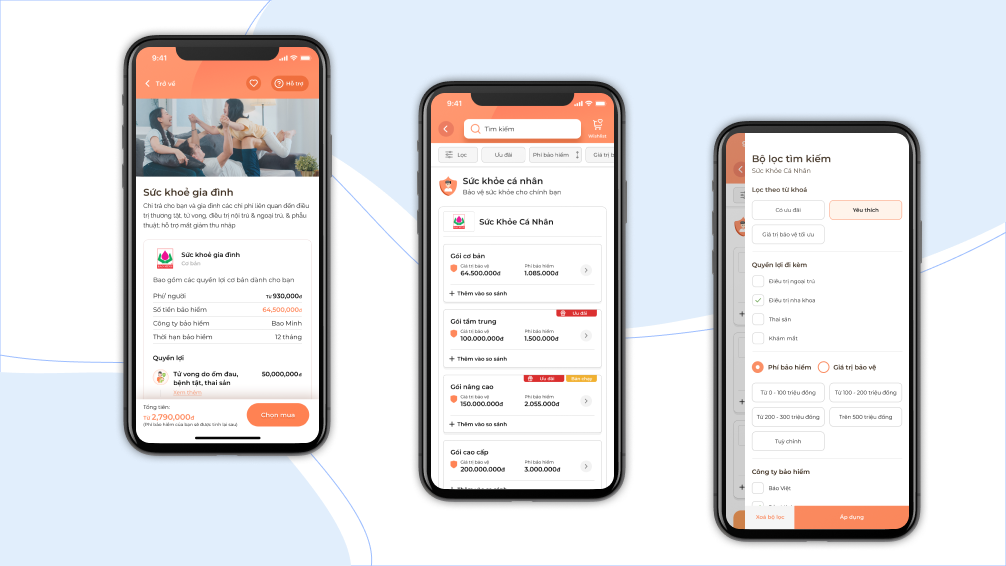

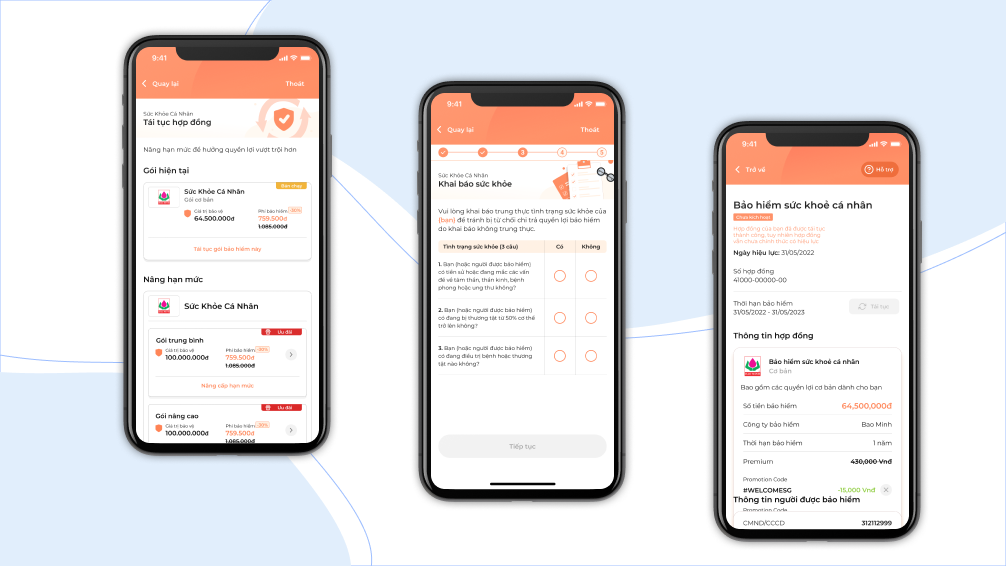

- Aimed to build a transparent, intuitive mobile UX to simplify product discovery and purchase for a digital-native audience.

Our Strategic Solution

ITC delivered an end-to-end digital transformation, designed for scale, innovation, and agility:

Scalable Insurtech Platform

- Built a cloud-native, big data-enabled B2C insurance ecosystem using AI and modern microservice architecture.

- Delivered a full-stack platform comprising the core system, responsive web portal, and native mobile applications.

Expert Full-Stack Team

- Deployed a dedicated full-stack engineering team responsible for the entire product lifecycle:

- System Architecture

- Database Design

- Solution Integration

- API Testing

- Functional Testing

- Deployment & BA Services

AI-Powered Loyalty Engine

- Designed and implemented an AI-driven loyalty platform with micro-segmentation capabilities.

- Enabled targeted engagement and retention strategies, optimizing customer lifecycle value and reducing churn.

Measurable Outcomes

- Scalability: Platform designed to support millions of users and high transaction volumes across multiple insurers and gateways.

- Speed to Market: Accelerated development through an end-to-end delivery team, reducing time-to-launch.

- Customer Retention: AI-powered loyalty engine increased engagement and improved retention in a competitive insurtech space.

- Unified Experience: Delivered a mobile-first, simplified UI/UX aligned with the digital habits of the Gen Z & millennial market.

Technologies Driving Results

React, React Native, Redux, Redux Thunk, TypeScript, Java, Spring Boot, RabbitMQ, MongoDB, Redis, Elasticsearch, PostgreSQL, Kubernetes, AWS, Docker, SOAP API

Industries

Insurance

Partnership Approach

A dedicated team model ensured alignment, expertise, and agility throughout the engagement.

The Bottom Line

IZIon24 successfully brought its bold insurtech vision to life—launching a highly scalable, AI-driven platform that meets the needs of today’s digital-first customers. With deep integration capabilities, powerful automation, and a user-centric design, the solution enables IZIon24 to lead innovation in Vietnam’s insurance market.