- Admin

- 6406 views

- 2 minutes

- Feb 20 2024

Transforming Customer Loyalty for ACB, a Leading Asian Bank

A Snapshot

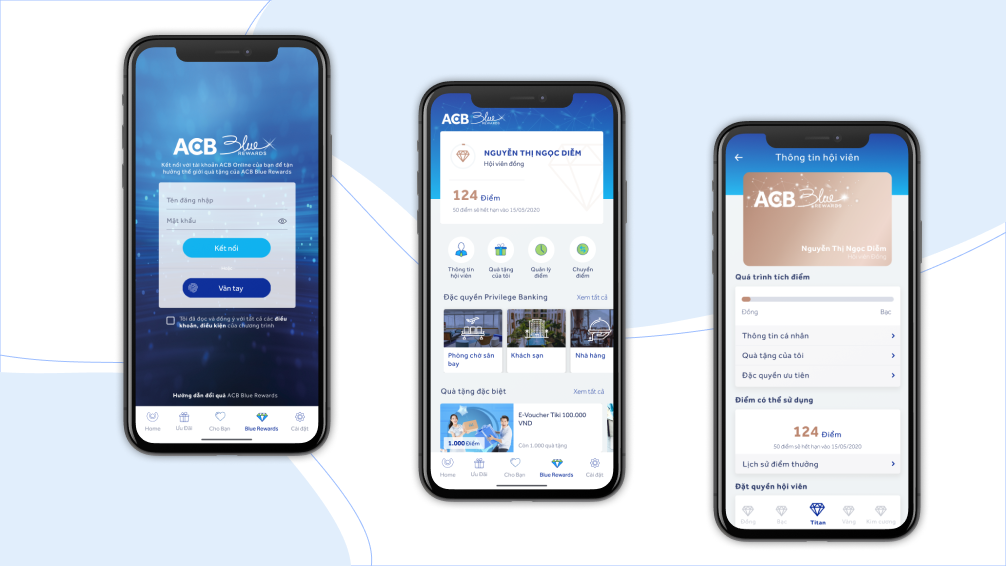

ACB, one of Asia’s largest private banks, sought to deepen customer relationships and elevate engagement through a cutting-edge omnichannel loyalty program. Partnering with ITC, they launched BlueRewards, a bespoke loyalty application designed to deliver personalized experiences, drive retention, and strengthen their market position.

The Business Challenge

ACB faced strategic hurdles in modernizing loyalty:

- Customization & Scale: They needed a flexible, scalable solution tailored to diverse customer preferences across millions of users.

- Security Imperative: Protecting sensitive personal and financial data in an omnichannel system was non-negotiable.

- Data Volume: Handling real-time streams of massive customer data outstripped existing resource capacity.

Our Strategic Solution

ITC delivered a comprehensive, end-to-end transformation:

Tailored Loyalty Ecosystem

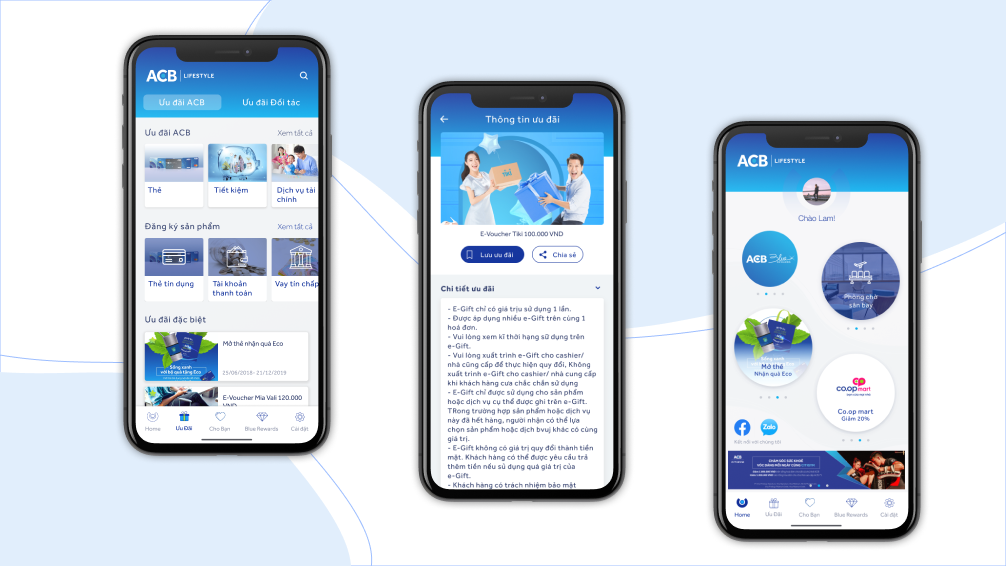

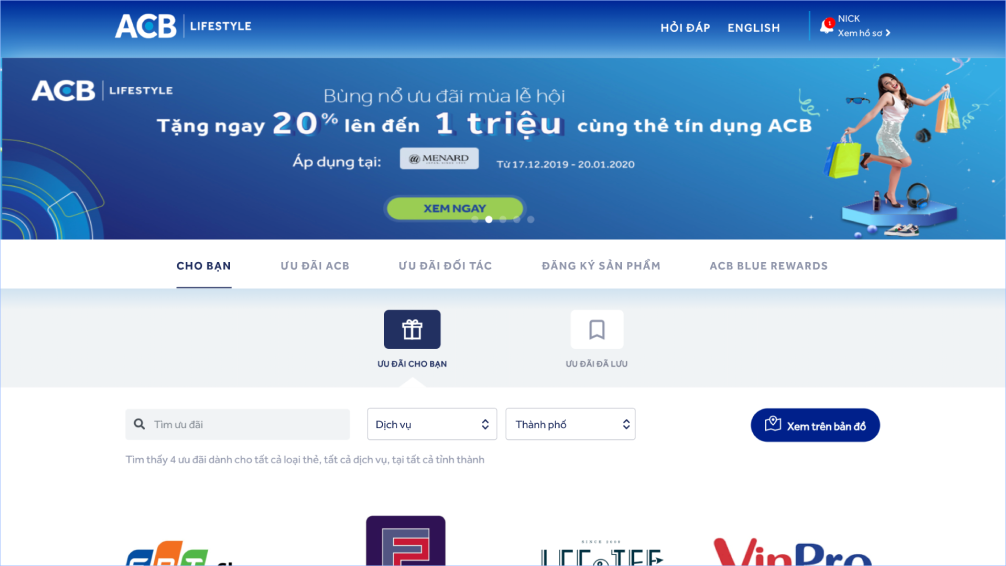

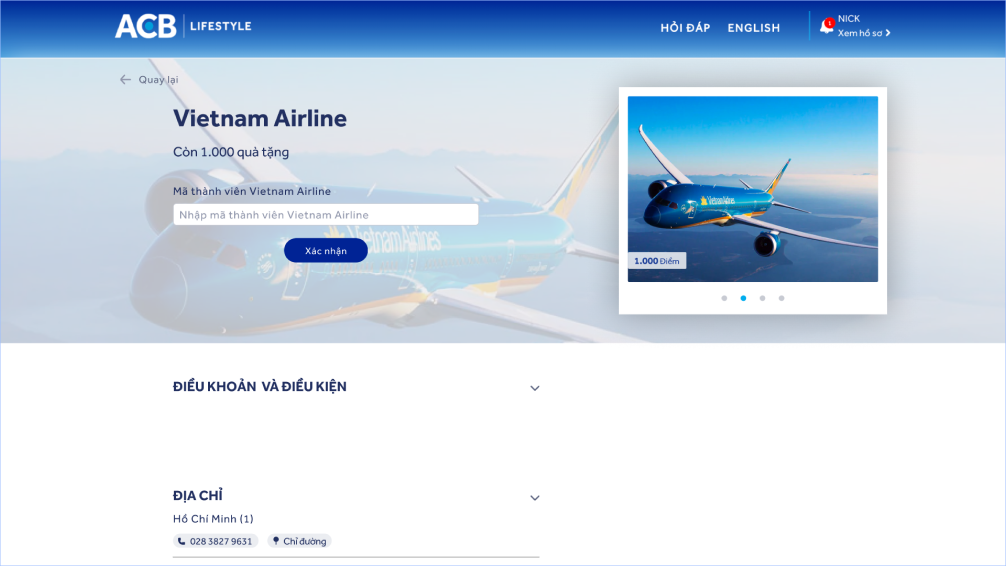

- Built BlueRewards as a cloud-based, scalable platform, enabling personalized offers based on real-time customer behavior insights

- Designed seamless front-end web and mobile apps, plus a robust CMS and admin portal.

Fortified Security & Performance

- Engineered a high-security architecture to safeguard data for 13+ million users and millions of daily transactions.

- Leveraged microservices and cloud scalability to ensure uptime and speed under peak loads.

Rapid Deployment

- Took the solution from concept to live in just 3 months, minimizing disruption and accelerating ROI.

Measurable Impact

- Speed to Market: Live in 3 months, outpacing industry norms.

- Scale & Engagement: 60K+ daily transactions and 800K+ active users, with 100% omnichannel consistency.

- Customer Loyalty Lift: Enhanced experiences driving retention and spending.

Why It Matters

For ACB’s executives, BlueRewards delivered:

- Competitive Edge: A standout loyalty program to differentiate in a crowded market.

- Trust & Compliance: Ironclad security protecting brand reputation and customer data.

- Revenue Potential: Deeper insights and engagement fueling upsell opportunities.

Project Essentials

- Approach: Dedicated team model

- Services: End-to-end development, UI/UX design, consulting, QA/testing, DevOps, maintenance

- Industry: Banking & Financial Services

- Tech Backbone: Cloud-based microservices (PHP, Symfony, React Native, PostgreSQL, Kubernetes, Docker), with tools like Elasticsearch, Kong API Gateway, and Firebase Crashlytics

The Bottom Line