- Admin

- 7955 views

- 2 minutes

- Feb 20 2024

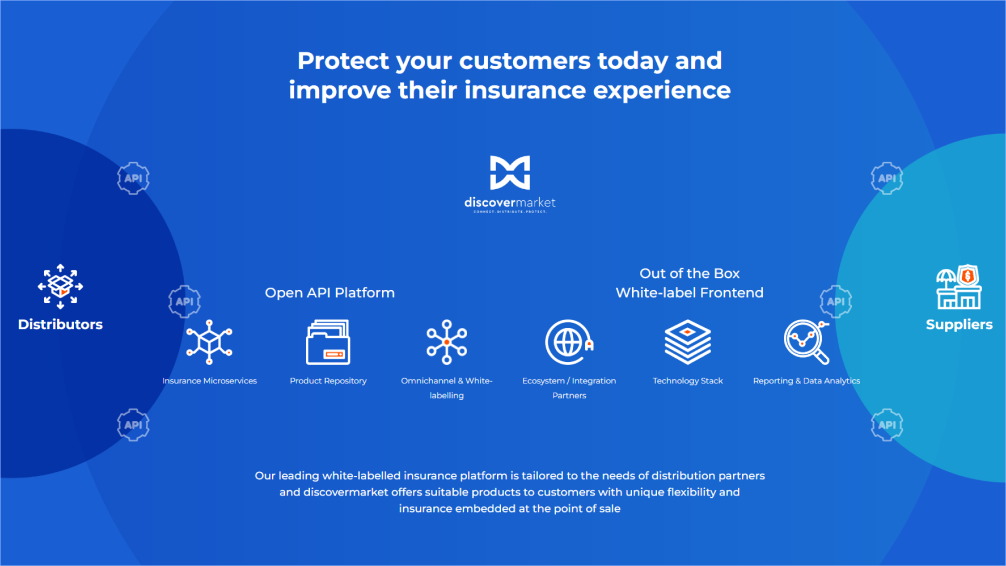

DiscoverMarket – Revolutionizing Embedded Insurance with a Scalable Platform

A Snapshot

The Business Challenge

DiscoverMarket faced complex hurdles:

- Platform Demands: A secure, scalable system was critical to enable users to compare quotes and manage products while ensuring admin efficiency.

- Architectural Complexity: A modern, microservices-based architecture was needed to guarantee performance and data security across millions of transactions.

- Team Coordination: Remote sub-teams across time zones struggled with communication and alignment, risking delays.

- Balancing Act: Ongoing maintenance competed with new feature development, threatening stability and innovation.

- Regulatory Navigation: Operating across countries required compliance with diverse regulations and cloud environments.

- Risk & Fraud: Manual processes for risk assessment and fraud detection slowed operations and introduced errors.

Our Strategic Solution

ITC delivered a phased, end-to-end transformation:

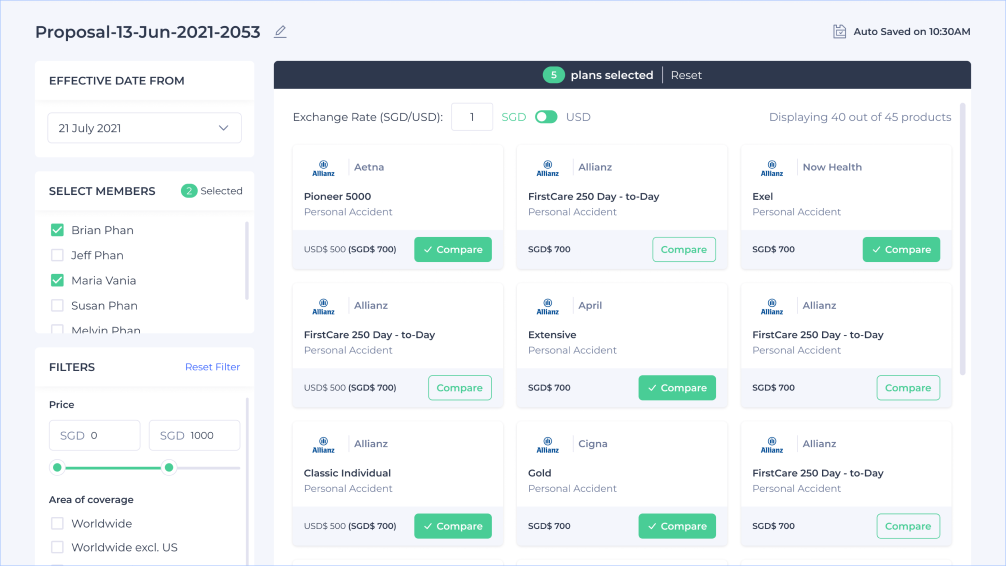

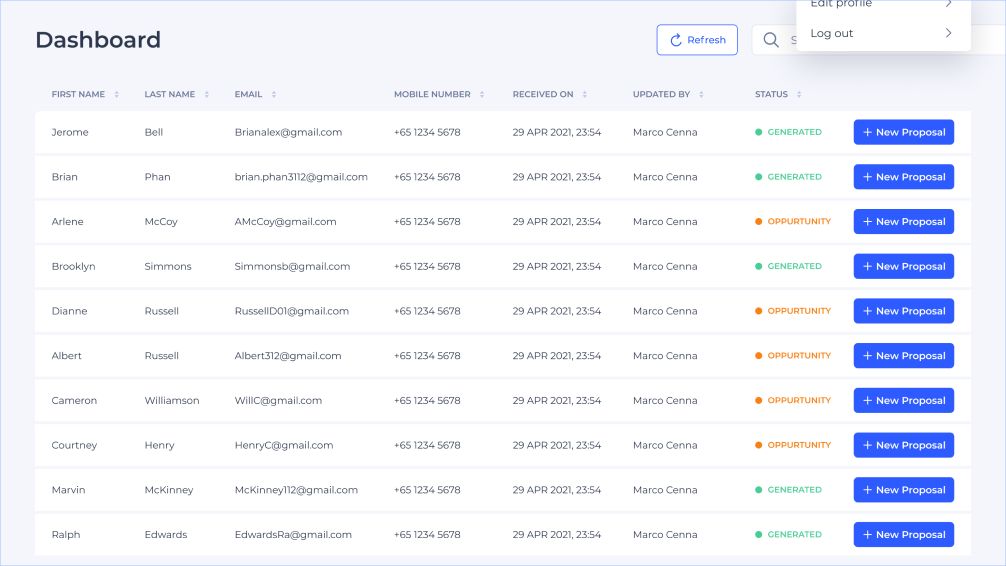

Scalable Marketplace

- Built a microservices and micro-frontends platform (M.A.C.H architecture) to handle 10K+ concurrent users and double delivery speed.

- Enabled real-time quote comparisons, product management, and reporting with a user-friendly interface.

Security & Performance

- Implemented passwordless authentication (Passkey) and AI-driven tools (e.g., ChatBot, GitHub Copilot) for a secure, high-performance ecosystem.

- Used a multi-cloud strategy (Azure, AWS) with sharding and replication to ensure data integrity and uptime globally.

Efficiency & Agility

- Adopted Trunk-Based Development and automated testing (100% website coverage) to accelerate deployment and maintain stability.

- Streamlined remote team workflows with Agile practices, overcoming time zone challenges.

Automation Advantage

- Integrated automated risk assessment and fraud detection, cutting manual effort and boosting accuracy.

Measurable Impact

- Speed: 2X faster delivery, from PoC to MVP.

- Scale: Handles 10K+ simultaneous users with zero downtime.

- Reliability: 100% automated testing ensures flawless performance.

- Efficiency: Reduced manual workload, freeing resources for innovation.

Why It Matters

- Market Differentiation: A standout platform in a competitive insurtech landscape.

- Customer Trust: Ironclad security and seamless UX to build loyalty.

- Growth Readiness: A scalable foundation to expand globally without friction.

Project Essentials

- Approach: Dedicated team model

- Services: Full-stack development (front-end, back-end, DevOps), QA/testing, consulting

- Industry: Insurance

- Tech Backbone: Microservices; Micro FrontEnds; Java; Spring Boot; Spring Cloud; Spring Retry; Spring JPA; Spring Aspects; Spring Security; Angular; State Management; RxJS; TypeScript; ES6+; HTML5 & Bootstrap; CSS; SCSS; TailwindCSS; Redis; MongoDB; CosmosDB; ELK; Active Directory; Virtual Network; AKS; Blob Storage; CDN; App Gateway; API Management; Developer Portal; WAF; Service Bus; App Services; Cosmos DB; Clarity; SAST; DAST; Automation Testing; CI/CD; JMeter; Jenkins; GitHub Actions; Gitlab Registry; NewRelic; Git-flow.

The Bottom Line