The financial sector is experiencing a radical shift with the emergence of cryptocurrency and blockchain technology. These innovations are reshaping the way we think about money, transactions, and the very nature of banking itself. As with any transformative technology, cryptocurrencies and blockchain come with both significant opportunities and notable risks for the banking industry. Let’s delve into this complex landscape and explore what it means for banks, regulators, and consumers alike.

1) Cryptocurrency and Blockchain Technology’s Background

Cryptocurrency, born in 2009 with the creation of Bitcoin, represents a form of digital or virtual currency secured by cryptography. Unlike traditional currencies, cryptocurrencies operate on decentralized networks based on blockchain technology. This distributed ledger technology records all transactions across a network of computers, ensuring transparency, security, and immutability.

Blockchain, the underlying technology powering cryptocurrencies, is a decentralized, digital ledger that records transactions across multiple computers. Each block in the chain contains a number of transactions, and every time a new transaction occurs, a record of that transaction is added to every participant’s ledger. The banking industry’s adoption of cryptocurrency and blockchain technology is still in its early stages. While some banks remain cautious, others are actively exploring ways to integrate these technologies into their operations. For example, JPMorgan Chase launched its own digital coin, JPM Coin, for instant transfers of payments between institutional clients.

Learn more about securing your financial data: Cybersecurity for the Banking Industry

2) Opportunities of Cryptocurrency and Blockchain Technology in Banking

The integration of cryptocurrency and blockchain technology offers several exciting opportunities for the banking sector:

- Enhanced Transaction Efficiency and Speed: Blockchain technology enables near-instantaneous settlement of transactions, significantly reducing the time required for traditional bank transfers. For example, Ripple’s blockchain-based payment network allows for cross-border transactions to be completed in seconds, compared to the days it might take through traditional banking channels.

- Reduced Operational Costs: By streamlining processes and eliminating intermediaries, blockchain can substantially reduce operational costs for banks. According to a report by Jupiter Research, blockchain deployments will enable banks to realize savings on cross-border settlement transactions of up to $27 billion by the end of 2030, reducing costs by more than 11%.

- Improved Transparency and Traceability: The immutable nature of blockchain provides an unalterable record of all transactions, enhancing transparency and making audits more straightforward. This could be particularly beneficial in areas like trade finance, where multiple parties need to track the movement of goods and funds.

- Potential for Financial Inclusion: Cryptocurrencies and blockchain technology can provide banking services to the unbanked population. In countries with limited banking infrastructure, mobile-based cryptocurrency wallets can offer a way for people to participate in the financial system.

- Innovation in Cross-Border Payments and Remittances: Blockchain technology can revolutionize international money transfers, making them faster and cheaper. For instance, Santander’s blockchain-based foreign exchange service, One Pay FX, allows same-day international money transfers at a fraction of the cost of traditional methods.

3) Risks and Challenges

Despite the promising opportunities, the adoption of cryptocurrency and blockchain technology in banking is not without risks:

- Regulatory Uncertainties: The regulatory landscape for cryptocurrencies and blockchain is still evolving, creating uncertainty for banks. Different countries have varying approaches, from China’s outright ban on cryptocurrency trading to El Salvador’s adoption of Bitcoin as legal tender.

- Volatility and Market Risks: The cryptocurrency market is known for its extreme volatility. For example, Bitcoin’s value has seen dramatic fluctuations, rising from around $7,000 in January 2020 to over $60,000 in April 2021 before falling back to around $30,000 by July 2021. Such volatility poses significant risks for banks considering cryptocurrency investments or services.

- Cybersecurity Concerns: While blockchain technology is inherently secure, the platforms and exchanges dealing with cryptocurrencies can be vulnerable to hacks. One of the biggest cases is the 2024 Indian crypto platform WazirX hack, where at least $230 million worth of cryptocurrency was stolen. This serves as a cautionary tale.

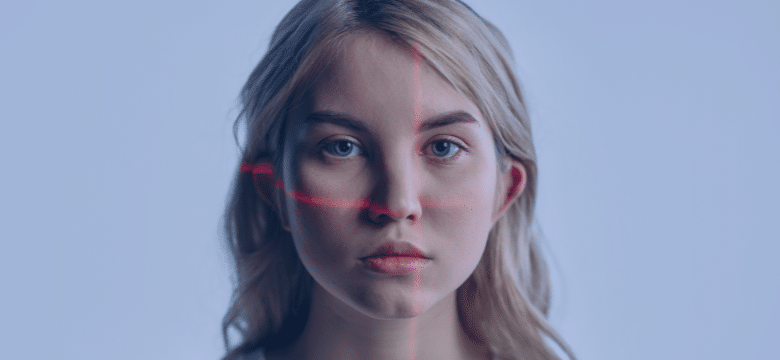

- Money Laundering and Illicit Activities: The pseudonymous nature of many cryptocurrencies has raised concerns about their use in money laundering and other illegal activities. Banks must implement robust KYC (Know Your Customer) solutions and AML (Anti-Money Laundering) procedures to mitigate these risks.

- Technological Limitations and Scalability Issues: Some blockchain networks face scalability challenges. For instance, Bitcoin’s network can process only about 7 transactions per second, compared to Visa’s ability to handle up to 65,000 transactions per second.

Learn the foundation of KYC: What is KYC and eKYC?

4) Implications for Stakeholders

The rise of cryptocurrency and blockchain technology has far-reaching implications for various stakeholders in the banking ecosystem:

- Banks and Financial Institutions: Banks need to adapt to this changing landscape or risk being left behind. This may involve investing in blockchain technology, partnering with fintech companies, or even developing their own cryptocurrencies. However, they must balance innovation with risk management and regulatory compliance.

- Regulators and Policymakers: Regulators face the challenge of creating a framework that fosters innovation while protecting consumers and maintaining financial stability. They need to develop new skills and understanding to effectively oversee these technologies.

- Consumers and Investors: For consumers, cryptocurrency and blockchain could mean faster, cheaper and more advanced banking services and new investment opportunities. However, they also face risks related to volatility, security, and potential fraud. Financial literacy becomes increasingly important in this new landscape.

5) Conclusion

Cryptocurrency and blockchain technology represent both a challenge and an opportunity for the banking sector. While they offer the potential for increased efficiency, reduced costs, and improved financial inclusion, they also bring risks related to regulation, volatility, and security. As these technologies continue to evolve, it’s crucial for banks to stay informed and adaptable. They need to carefully weigh the potential benefits against the risks and develop strategies that allow them to leverage these innovations while managing the associated challenges.

Are you looking to navigate the complex world of cryptocurrency and blockchain in banking? At ITC Group, we offer comprehensive IT Strategy & Software Consulting Services to help financial institutions leverage these technologies effectively. Our team of experts can guide you through the opportunities and risks, ensuring you’re well-positioned for the future of banking. Contact us today to learn how we can help your institution thrive in this new digital landscape.