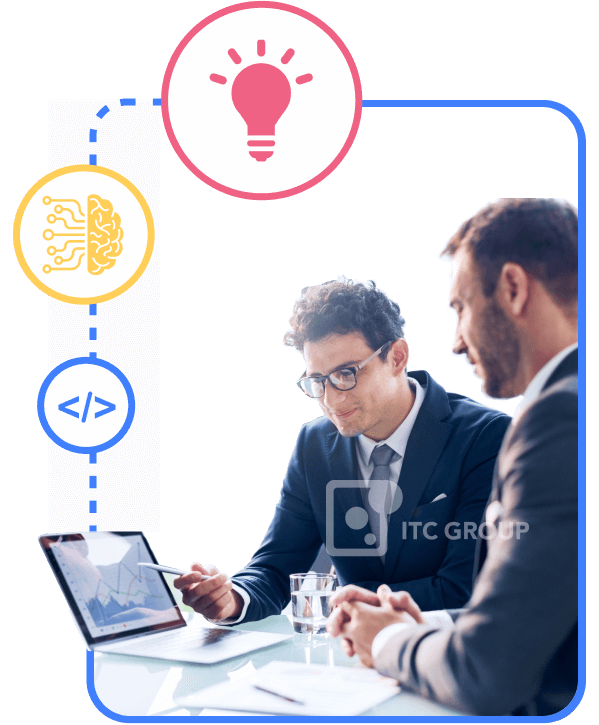

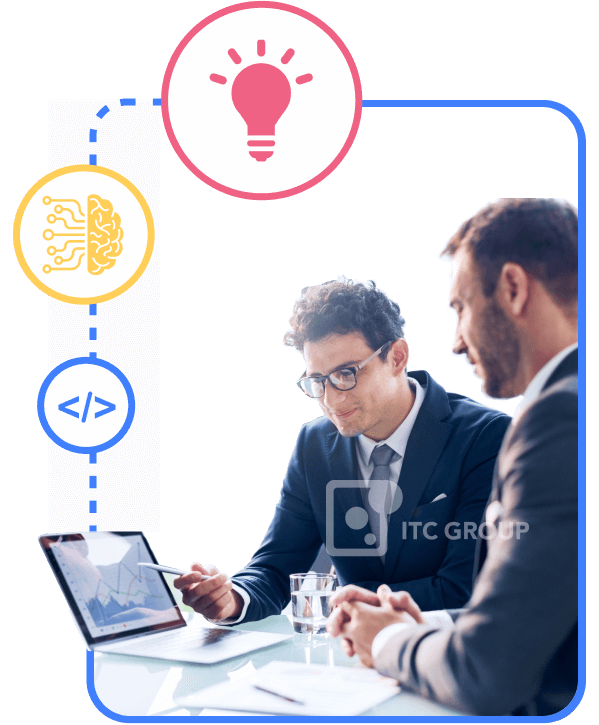

Trusted technology consulting partner

for software development and innovation worldwide

Accelerate businesses' success with leading industries' expertise and mature software development processes.

Tailor your needs with the best-fit technology solution by fully comprehending your business domain insight.

Increase efficiency and uplift productivity by adding Agile principles to our mature software development processes.

Achieve your business goals confidently by accompanying us from consulting to development and operation.

Stay your business ahead of the curve with our wide range of technology stacks adoption

We provide high-quality software development services backed by an ecosystem of our global partner networks.

We take pride in our work and embrace growth at the forefront.

Our comprehensive range of IT outsourcing and software development services are tailored to your unique requirements.

Guide your path to excellence with our expert consulting advice for design, code quality and mature process.

Elevate your software development journey with full product lifecycle, platform modernization, and ongoing maintenance.

Enhance your software performance with context-driven approaches, automation, and performance & security for bug-free and flawless operation.

Maximize your efficiency with our agile development, seamless operations for the large mission-critical systems with the fast development cycle.

Digitize operations with Mobile Banking, Mobile Payment, Buy Now Pay Later (BNPL), eKYC, AI and Block-chain based solutions.

Level up your system with autocare insurance, autocare tracking, omnichannel distribution, sales support tool, robotic process automation (RPA) and customer relationship management (CRM).

Maximize profits with personalization through AI, Mobile Shopping App, Video Shopping, Live streaming shopping, Chatbot and Bot Analytics, AR & VR and much more.

Empower operations with learning management systems (LMS), e-learning applications, AR & VR

Boost efficiency and creativity in your media production efforts with OTT content advertisements, Digital Content Management, Event apps, Gaming boost.

Amplify your charitable efforts with cloud computing, data analytics, CRM and donor management systems, social media integration and more.